Over the next few years, global meat production will increase significantly, which may lead to price fluctuations on the soybean market. At the same time, consumers have higher demands in terms of traceability and eco-balance. This is a particular challenge for Europe, as a large proportion of the required protein feed comes from abroad.

See the interactive infographics to find out what is happening in Europe and how gaps could be filled.

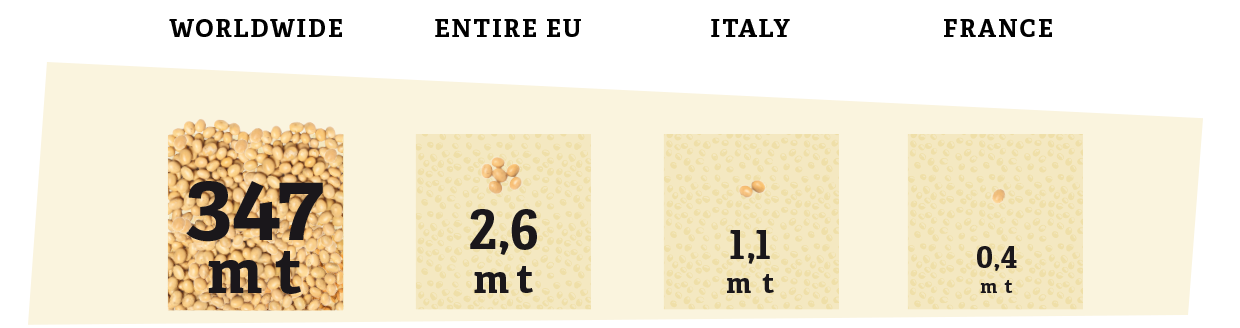

SOYA PRODUCTION WORLDWIDE AND IN EUROPE

Italy and France are the largest soya producers in Europe. Of the 347m t of soya produced worldwide, 80% goes to the food industry for oil and protein production. After pressing or extraction, soya meal remains for animal feed.

IMPORTS INTO THE EU

32,4m t

14.1m t of soyabeans and 18.3m t of soyabeans meal are imported into the EU 28 per year.

EUROPEAN AUTONOMY BY PROTEIN CONTENT CATEGORY

Discover the proportion of self-sufficiency depending on the protein group:

protein content< 15%

protein content15-30%

protein content30-50%

EU 28 TOTAL PROTEIN USE

Sorted by source, in million t raw protein

18,54m tCrops38m tRoughage25,95m tCo-products from pressing2,5m tNon-plant sources

18,54m tCrops38m tRoughage25,95m tCo-products from pressing2,5m tNon-plant sources

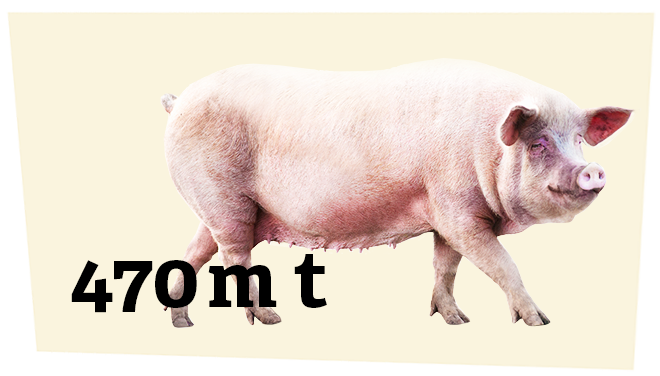

DEVELOPMENT OF MEAT PRODUCTION

In the mid-term, no price explosion is to be expected on the soyabean market: Projections by the USDA predict a soyabean meal price increase of only $35 (£29)/t by 2027/2028. In the long term, some parameters point to possible supply bottlenecks. For example, the increase in global meat production, according to the FAO.

HOW TO CLOSE THE GAP?

Old and new protein sources offer solutions for more independence

RAPESEED CAKE

RAPESEED CAKE

Rapeseed meal with low fibre content and protein content up to 46% thanks to new processing methods

PEAS, BEANS, LUPINS AND CO

PEAS, BEANS, LUPINS AND CO

Good candidates to boost self-sufficiency in mid to high protein levels

EUROPEAN SOYA

EUROPEAN SOYA

There is hope that breeding will help adapt soya to European climates and get rid of unwanted ingredients

INSECTS

INSECTS

Very good amino acid patterns and unbeatable area efficiency – but EU legislation could be an obstacle

BACTERIA

BACTERIA

They turn CO2 into a highly concentrated protein product. However, environmental footprint needs to be improved

ALGAE

ALGAE

With 50% crude protein content, they are a good source of protein for pigs, but currently expensive to produce

SOURCES: FAO, DG AGRI (FIGURES 2017-2018), AGRESTE